– Kesa Zahera

INTRODUCTION

“Our planet is a lonely speck in the great enveloping cosmic dark. In our obscurity, in all this vastness, there is no hint that help will come from elsewhere to save us from ourselves. The Earth is the only world known so far to harbour life”. These lines by Carl Sagan explain the reality of the world where we live. It indicates the advent of initiating action towards preserving our civilisation. Therefore, climate change has metaphorically turned into a toxic phenomenon threatening the possibility of life forms on Earth.

To effectively address these pressing issues, it is crucial to adopt an efficient and sustainable approach over the long run. While affirmative national policies, intervention from global organisations, and sustainable guidelines play vital roles in fostering accountability and public awareness of climate change, more is needed to achieve sustainable development. In a market-oriented economy, capital markets emerge as pivotal engines of nations. They wield considerable influence over borrower behaviour, impacting infrastructural development and the various factors of production. Therefore, an infusion of capital investment towards environmentally friendly “green” projects can establish a self-sufficient system, which can degrade climate fluctuations. By shifting the focus of investment, capital markets can contribute substantially to address climate change and promote sustainability. This strategic redirection aligns with broader environmental objectives and fosters a more resilient economic framework.

DECONSTRUCTING GREEN BONDS

Bonds offer issuers a source of long-term financing at a lower cost than traditional bank loans, making them particularly beneficial for investments in infrastructure and other long-term projects. The International Finance Corporation (IFC) advocates for green bonds as a natural solution to meet the increasing demand for longer-term capital, specifically for climate-screened low-carbon and climate-resilient assets. Green bonds operate similarly to conventional bonds, with the vital distinction being that the capital raised must be invested in sustainable projects. However, they typically yield smaller returns, known as a “Greenium,” due to their lower risk profile. Organisations, including governments, corporations, and financial institutions, can issue green bonds, with third-party organisations often validating their legitimacy to give investors trust and prevent misleading claims. This approach fosters a climate-conscious financial ecosystem. The concept of green bond financing was introduced in 2007 as part of the Paris Agreement, which is in line with the United Nations Sustainable Development Goals, providing a framework for their functionality. Many borrowers adhere to the Green Bond Principles, endorsed by the International Capital Market Association, which aim to enhance transparency in the market.

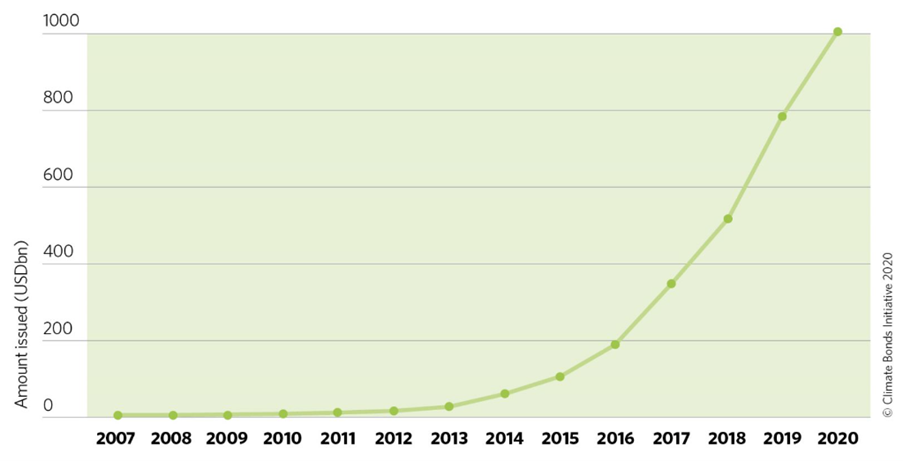

The following graph below depicts the cumulative progression of green bonds over 2017-2020. This indicates that this bond market is expanding exponentially.

INDIA’S ROLE IN GREEN BONDS’ FINANCING

The transformative power of these bonds extends to developing nations, where they serve as incentives for climate action among investors, capitalists, and industrialists alike. These bonds have become essential to attract foreign direct investments (FDI) in developing countries. Notably, on January 25, 2023, India issued the first tranche of its inaugural sovereign green bond, valued at INR 80 billion (equivalent to $980 million). Following this milestone, on February 9, 2023, the Government of India announced another tranche of INR 80 billion ($968 million) in sovereign green bonds.

India stands to benefit significantly from this burgeoning trend. The nation’s largest green bond issuer, Greenko Group, is channelling funds into hydro, solar, and wind power projects across several Indian states with the proceeds from its green bonds. Additionally, there are notable examples of subnational entities embracing green financing, such as Ghaziabad Nagar Nigam, the first Indian local government to issue a green bond (amounting to USD equivalent of 20 million in 2021), and the Indore Municipal Corporation, which issued USD 87 million in green bonds in 2023.

The growing prevalence of green bonds, particularly in emerging markets like India, is poised to yield substantial benefits in the future. By attracting investments into sustainable projects, India can bolster its infrastructure, mitigate environmental degradation, and accelerate its transition towards a low-carbon economy. Furthermore, these investments can spur job creation, enhance energy security, and contribute to economic resilience and competitiveness. India’s proactive stance in embracing green financing underscores its commitment to sustainable development and positions it favourably for long-term growth and prosperity.

CONCLUSION

While green bonds have emerged as a promising tool for financing sustainable projects and fostering environmental stewardship, their effectiveness is scrutinised amidst the rise of sustainability-linked bonds. Unlike green bonds, sustainability-linked bonds offer more flexibility in fund allocation, potentially diluting the intended impact by allowing investments for general corporate purposes. This raises concerns regarding the genuineness of green investments and the risk of greenwashing. The critical determinant of green bonds’ efficacy is whether issuing firms genuinely increase their green investments or engage in superficial gestures. Unlike conventional bonds, green bonds mandate transparent disclosure of fund utilisation and subsequent environmental benefits, mitigating the risk of greenwashing. Nonetheless, the challenge remains in ensuring that green bonds fulfil their intended purpose of driving tangible environmental progress rather than serving as mere financial instruments.

As the green bond market evolves, stakeholders must remain vigilant in upholding transparency, accountability, and authenticity in green investments. By addressing these challenges and harnessing the transformative potential of green financing, we can pave the way for a more sustainable and resilient future.

References

“Sustainable Development Bonds – Green Bonds” World Bank Treasury, October 19, 2023

https://treasury.worldbank.org/en/about/unit/treasury/ibrd/ibrd-green-bonds

“What are green bonds and how can they help the climate?” The World Economic Forum, November 22, 2023

https://www.weforum.org/agenda/2023/11/what-are-green-bonds-climate-change/

Pattanayak, Banikinkar. “India plans to spend 44 per cent more on projects through green bonds” The Economic Times, February 5, 2024

Tuhkanen, Heidi. “Green Bonds” Green Bonds: A Mechanism for Bridging the Adaptation Gap? Stockholm Environment Institute, 2020, pp. 8–15. JSTOR

http://www.jstor.org/stable/resrep22964.5

Author:

Kesa Zahera

Research Associate, GAEE India

Editors:

Aidamon Talang

Editor-in-chief, GAEE India

Kavya Suri

Associate Editor, GAEE India

Recent Comments