Introduction

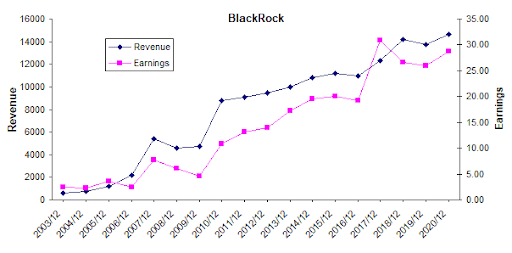

Few names are as well-known in the fast-paced world of banking and investments as BlackRock. BlackRock, which started off as a microscale bond investing company in 1988, has grown into a global financial behemoth that oversees trillions of dollars’ worth of assets. The article examines the history of BlackRock along with the financial tactics, macroeconomic factors, and moral considerations that helped the company rise from obscurity to corporate wealth. Its path to corporate eminence included a crucial spin-off in 1994, iShares’s invention of the exchange-traded fund (ETF) market in 2000, strategic acquisitions like Merrill Lynch Investment Management in 2006 and Barclays Global Investors in 2009 (which included the iShares business), and a ceaseless focus on innovation. BlackRock’s assets under management (AUM) increased to trillions of dollars while Larry Fink served as Chairman and CEO, solidifying the company’s position as a major player in the global financial industry.

The Birth of a Financial Giant

When Stephen A. Schwarzman, Larry Fink, and other visionaries joined hands towards a shared vision for a financial organization that would revolutionize the asset management business in the late 1980s, that is when BlackRock was born. They set out on a journey with a goal to become the best in the business of managing fixed-income assets.

The founders of Blackrock were motivated by a clear sense of purpose, and driven by the desire to bring a change, they identified a market gap and a chance to better fixed-income investment options by continued innovation. The vision of BlackRock, which went beyond simply producing money to also deliver value to investors, laid the path for a corporate culture that was firmly built on customer-centric principles.

The strategic positioning of BlackRock in the competitive banking industry emerged as a factor for its early success. In order to differentiate itself from conventional asset managers, the company introduced unique and simplified investment methods and technologies. A significant game-changer for BlackRock was the invention of exchange-traded funds (ETFs), which gave investors the access to diverse portfolios of assets with unmatched efficiency and transparency.

BlackRock was successful in luring and retaining elite talent in the sphere of finance, while making sure that the employees possess the required creative freedom to think innovatively and adapt to the dynamic market conditions.

Strategic Financial Management

BlackRock’s rise to prominence in the global financial sector has been built on the principle of strategic financial management. The driving force behind this strategic strategy is Larry Fink, whose inspirational leadership has been vital in determining the company’s success.

- Stress on Risk Management: A strict approach to risk management is one of the fundamental principles of BlackRock’s strategic financial management. Larry Fink understood that good risk assessment and mitigation are crucial to safeguard client assets and maintain long term profitability. To monitor and manage risk variables across its broad portfolio, the corporation adopted advanced risk models and analytics into practice.

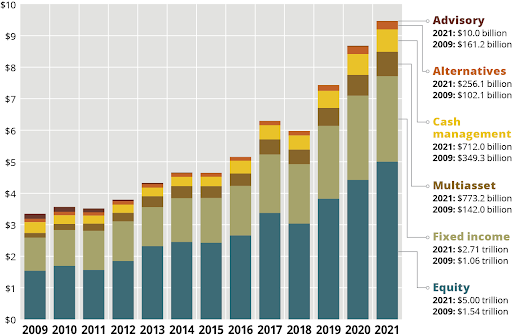

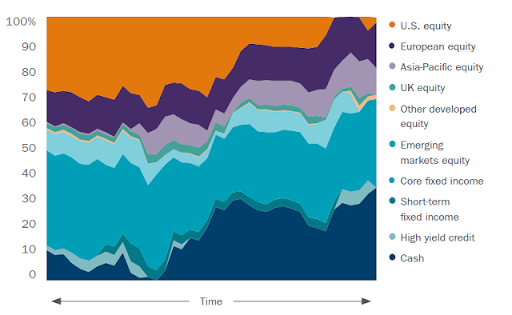

- Diversification: Another important component of BlackRock’s financial strategy is its dedication to diversification. To lower risk, investments should be distributed across a variety of asset types and geographical areas. With a wide array of investment products offered by BlackRock, including equities, fixed income, alternatives, and multi-asset solutions, customers can create diversified portfolios that are tailored to meet their unique objectives and risk tolerance.

- Long-Term Investment Horizon: BlackRock has stood out in a field that is frequently dominated by short-term thinking thanks to Larry Fink’s long-term vision. The company has so far assisted customers and investors in weathering market turbulence and taking advantage of opportunities that present themselves over time by urging them to adopt a patient, long-term investment mindset. This strategy is in line with the company’s dedication to generating sustainable returns.

- Innovative Financial Management: BlackRock’s strategic financial management stands out through its innovative approaches, such as pioneering exchange-traded funds (ETFs). These ETFs provide investors with cost-effective access to diverse asset classes and investment themes, boasting exceptional liquidity. Notably, BlackRock’s iShares ETFs have taken a commanding lead in their respective markets, attracting global investors and significantly driving the company’s growth.

- Global Reach and Local competence: BlackRock’s financial strategy harmonizes local expertise with a strong global footprint. Leveraging its well-established international presence, the firm gains valuable insights from diverse markets and geographic regions. This approach empowers BlackRock to consistently offer expertise and service to clients worldwide while tailoring its investment strategies to the unique attributes of different economies.

Economic Policies and Global Expansion

BlackRock’s performance is inextricably related to its capacity to understand, interpret, and take advantage of economic policies and globalization.The business cleverly adopted and implemented economic principles and strategies for global expansion to cement its status as a financial behemoth.

- Globalization and Economic Policies: BlackRock’s ascent took place at a time when financial industry globalization was facing an acceleration. Domestic and international economic policies stood crucial in shaping the environment in which BlackRock functioned. These regulations have a direct and lasting impact on things like trade, capital movements, and regulatory structures.

- Expansion internationally: BlackRock strategically increased its footprint abroad after realizing the potential that came with globalization. This growth included new economies as well as well-established markets. As a result, BlackRock managed to transform into a truly global financial powerhouse, poised to navigate the complexities of the ever-evolving international investment landscape with agility and expertise.

- Regulatory Compliance: One of the key components of international expansion is navigating the intricate web of financial rules. In order to ensure that it worked within the legal frameworks of the nations it entered, BlackRock made investments in compliance and regulatory knowledge. This dedication to regulatory compliance helped establish trust with clients and regulators while also ensuring legal conformance.

- Asset Allocation in Emerging economies: BlackRock actively allocated resources to take advantage of these opportunities after recognizing the growth potential in emerging economies. Building ties with important players involved conducting study on regional marketplaces and understanding cultural nuances.

Ethical Considerations and Responsible Investing

BlackRock’s path to corporate prosperity goes beyond simple financial advantages; it is a reflection of a steadfast dedication to moral leadership and ethical investing. Early on, the company’s leadership understood the enormous responsibility that comes with its position as a significant asset manager and the potential influence that its investment choices could have on society and the environment. BlackRock radically changed how it evaluated businesses and industries by embracing environmental, social, and governance (ESG) principles and incorporating these considerations into its investment procedures. Beyond internal adjustments, BlackRock emerged as a strong proponent of ethical business practices, actively engaging with portfolio businesses to spark improvements in governance and sustainability. Due to this dedication, a wide range of sustainable investing products have been developed, allowing clients to connect their investments with their values and pursue financial gains.

Conclusion

In conclusion, BlackRock’s rise to prominence on a worldwide scale is an example of a multidimensional success story that goes beyond simple wealth creation. At its foundation, it is a story about wise financial judgment, exemplified by the company’s aptitude for navigating complicated and turbulent financial markets with accuracy and caution. Risk management, diversification, and a long-term outlook are key components of BlackRock’s commitment to strategic financial management, which is driven by visionary leadership. These concepts have not only helped the company stay resilient, but have also helped its clients achieve financial success.

Also proving BlackRock’s flexibility in adapting to evolving global economic situations, the company’s performance is entwined with its adaptable economic strategy. BlackRock has maintained its growth through seeing and capturing chances in developing countries and by being flexible to shifting economic conditions.

BlackRock’s leadership in this area not only appeals to socially conscious investors but also sets a standard for the larger financial industry at a time when ethical considerations are becoming more important. It supports the idea that ethical governance and responsible financial management can live peacefully in the future, paving the way for a more sustainable and diverse financial system.

BlackRock’s story serves as a beacon of what can be achieved when financial acumen, business possibilities, and moral ideals come together and stands as a testament to the enduring power of these principles in navigating the complexities of the global marketplace.

The introduction of corporate green bonds has been a revolutionary step showcasing the sensitivity towards the environment both on the part of the issuer as well as the buyer of the bond. This will, in the long term, lead to a cleaner and more sustainable environment to live in.

References

1. Massa, Massimo and Schumacher, David and Wang, Yan (2020). Introduction and History of Blackrock. INSEAD Working Paper No. 2015/60/FIN. http://dx.doi.org/10.2139/ssrn.2641078

- A Haldanen (2014). Risk Management and Diversification. The age of asset management. https://citeseerx.ist.psu.edu/document?repid=rep1&type=pdf&doi=1df4edb6e73ca97594b2cf4a3226b9bef5be8bce

3. Matthew Backus, Christopher Conlon, Michael Sinkinson (2019). Long Term Investment Horizon. The Common Ownership Hypothesis: Theory and Evidence. https://chrisconlon.github.io/site/co_brookings.pdf

4. Business Wire (2021). Global expansion of Blackrock. BlackRock Real Assets Achieves a US$1.67 Billion Final Fundraise for Inaugural Global Infrastructure Debt Strategy. https://www.businesswire.com/news/home/20210614005075/en/BlackRock-Real-Assets-Achieves-a-US1.67-Billion-Final-Fundraise-for-Inaugural-Global-Infrastructure-Debt-Strategy

5. Blackrock (2023). Global asset allocation. Global Allocation Fund. https://www.blackrock.com/us/individual/insights/global-allocation-monthly

6. Blackrock (2023). Ethical Considerations and Responsible Investing. Getting granular: 2023 Global Outlook Q4 update. https://www.blackrock.com/corporate

Recent Comments