Understanding Bonds

Corporations globally are now recognising their responsibility towards environmental conservation and sustainable development and thus are advocating for the use of greener and more sustainable business practices, which has led to the emergence of the concept of corporate green bonds. Let us first understand the usual corporate bonds. A corporate bond is a financing instrument used by companies to raise funds that carry a predetermined rate of interest to be given to the lender unlike shares, which do not have any predetermined rate of interest. For example, suppose XYZ Ltd. wants to expand its operations and thus needs Rs. 100 crores. It can either issue shares for the same which will dilute the holding of existing shareholders or it can take it as a loan in the form of bonds. Suppose it gives ten lac bonds of face value thousand each at the interest rate of 10% per annum, thus fetching it a fund of 100 crores from the public, who shall get an interest of 10% p.a with their principal amount back after a predetermined period.

Corporate green bonds, that is, bonds whose proceeds are committed to finance environmental and climate-friendly projects, such as renewable energy, green buildings, or resource conservation, are a recent development in corporate finance. They bear a fixed rate of interest just like a regular corporate bond has a predetermined redemption date, but the differentiating factor is the use of funds. Unlike typical bonds, Corporate green bonds are used by organizations to fund projects that will have a positive impact on the environment.

Emergence of Green Bonds

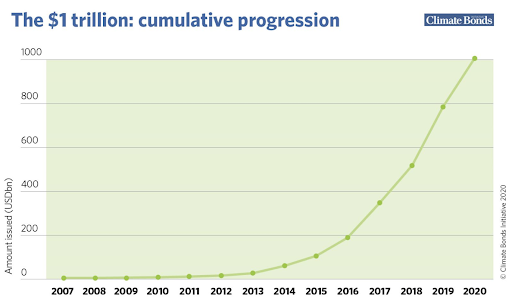

The concept was not renowned before 2008 until the World Bank issued its first-ever corporate green bond, and since then, their popularity and usage has been increasing. Morgan Stanley names this surge as the “green bond boom” because of a skyrocketing surge in the use of Green Bonds, increasing the value of bonds from 5 Billion USD in 2013 to 96 Billion USD in 2018 around the globe (Flammer, 2021). However, the origin of these bonds is associated with the City of San Francisco in the United States, wherein a ‘solar bond’ was approved to fund renewable energy. Also, in 2007, some development banks, such as the European Investment Bank, issued an Equity index-linked bond of such a type (IFC website).

Driving Force to Issue Green Bonds

Let’s understand the rationale behind the concept of corporate green bonds and its significance for issuing organizations and other stakeholders. The biggest motivation for a company to issue a corporate green bond is that it exhibits the company’s commitment to the conservation of the environment, which nowadays is a critical determinant of the goodwill of an organization. It indicates that the company wants to improve its environmental footprint and thus instills accountability amongst the environmentally conscious stakeholders. Next, since green bonds are issued for a good cause, they can be issued at a lower cost to the company, thereby cutting the cost of capital. Another benefit is that Corporate green bonds offer organizations an extra road to raise capital for their sustainability drives. With the rising interest in environmentally sensitive ventures, green bonds attract a broader investor base, including institutional investors, asset managers, and impact-focused funds. Also, larger attention given by the media provides the issuer an opportunity to communicate the firm’s green investment strategies more clearly to the investors. Rising media exposure about green bond issuance by the company has also been said to strengthen a firm’s Environmental, Social, and Governance profile and give companies opportunities to increase their investor base, which in turn can contribute to positive abnormal returns.

Regulation of Green Bonds

The issuance of Corporate green bonds is guided by Green Bond Principles (GBP), which were brought in by International Capital Market Association (IMCA) in order to fill the possible loopholes in their issuance and ensure transparency. They broadly cover 4 components which are described as follows: –

(i) Use of proceeds: It lists the purpose of issues that are eligible for the ‘green bond’ tag and thus outlines the eligibility of green bonds. It states that the project should be environment focused.

(ii) Process for Project Evaluation and Selection: GBP has enlisted the factors to be considered while stating the issuance as a ‘green bond’. It requires clear communication regarding the details of the project, including risks associated, managing any potential material, and others.

(iii) Management of Proceeds: GBP necessitates the management of funds in a sub-account or a sub-portfolio. Also, the fund management process should be transparent and aligned with the project’s target.

(iv) Reporting: It details how the progress and impacts of the project need to be reported. It states all the information that should be updated, such as the use of proceeds, a brief project description, allocations, etc. The issuer could also report on the estimated impact of the bonds.

Impact on Stock Markets

Research conducted by Caroline Flammer suggests that the stock market has a positive reaction towards the issue of corporate green bonds in a short period around the declaration and issue of the bonds, which was further validated in a study conducted by a Norwegian School of Economics student. The underlying reasons for the same that have been postulated by Flammer include (i) a positive stock exchange response to the declaration of green bond issuance, (ii) a stronger response for certified green bonds (i.e. Green bonds for which the signal is more costly), and (iii) a stronger response for first-time issuers (i.e. when the green bond signal is provided to the market for the first time). They also experience a change in the holding of the company in the sense that a company issuing green bonds experiences a surge in long-term and green investors post-completion of the issue (Flammer, 2021).

Conclusion

To conclude, we can say that the green bonds have marked their presence in various countries, primarily in developed nations and a few growing economies. The following picture shows the countries which have witnessed the issuance of green bonds

The introduction of corporate green bonds has been a revolutionary step showcasing the sensitivity towards the environment both on the part of the issuer as well as the buyer of the bond. This will, in the long term, lead to a cleaner and more sustainable environment to live in.

References

- Flammer, C. (2021). Corporate green bonds. Journal of Financial Economics, 142(2), 499–516. https://doi.org/10.1016/j.jfineco.2021.01.010

- International Finance Corporation (IFC). (n.d.). https://www.ifc.org/wps/wcm/connect/news_ext_content/ifc_external_corporate_site/news+and+events/news/insights/perspectives-i1c2#:~:text=The%20Origins%20of%20Green%20Bonds,supply%20of%20investable%20green%20bonds.

- The International Capital Market Association » ICMA. (n.d.-b). https://www.icmagroup.org/assets/documents/Media/Brochures/Green-Bond-Principles-brochure-May-2015.pdf

- CORPORATE GREEN BONDS. (n.d.). www.bu.edu. https://www.bu.edu/gdp/files/2018/11/GEGI-GDP.WP_.Corporate-Green-Bonds.pdf

- The stock market reaction due to green bond issuance announcements on the European Market. (n.d.). www.diva-portal.org. https://www.diva-portal.org/smash/get/diva2:1678675/FULLTEXT01.pdf

- Verma, R. M., & Bansal, R. (2021). Stock Market Reaction on Green-Bond Issue: Evidence from Indian Green-Bond Issuers. Vision: The Journal of Business Perspective, 27(2), 264–272. https://doi.org/10.1177/09722629211022523

- Green bonds: Country experiences, barriers and options – OECD. (n.d.). https://www.oecd.org/environment/cc/Green_Bonds_Country_Experiences_Barriers_and_Options.pdf

Recent Comments