Background and Development of Interest Rates

During the COVID-19 Crisis, which started in 2019 and lasted till 2021, many economies worldwide saw business closures, an increase in unemployment, and a decrease in the velocity of money as people were restricted to their homes and were asked to Work From Home (WFH). As a result, to prevent the economy from going into a depression, the Fed decided to use expansionary fiscal and monetary policy coupled with Quantitative Easing. Further, the Fed used Forward Guidance, a financial tool under which it is stated that it would keep interest rates at zero until it is felt that the economy has been able to rise above the difficulties.

Since the interest rates were close to zero, this encouraged many inventors, particularly angel investors and venture capitalists, to borrow funds at a lower cost and then invest the borrowed funds in startups or in the capital markets in the hope of getting better returns together with the equity in the business they were going to get. Since there was no interest, it encouraged these investors to take higher risks in the hope of getting higher expected payoffs. Hence, the COVID pandemic saw a rise in venture capitalism as the costs associated with losing were low compared to those of winning, as explained by loss aversion theory.

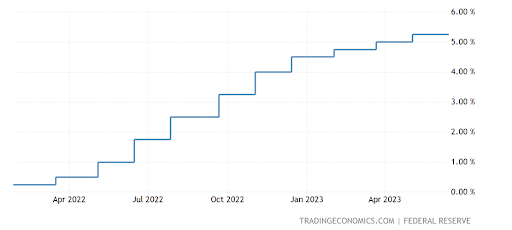

However, due to the continuous printing of money at a non – equilibrium level, it forced the US economy to experience high inflation. As a result, The Fed started increasing the Federal Funds rate from 1% in April 2022 to the current 5.25%. This, coupled with the Russia – Ukraine crisis, has proved to be quite worrisome for investors.

Influence Of Interest Rates On The Stock Market

Changes in interest rates have an immediate impact on the short term movements of a stock. Earnings and stock prices are inversely proportional to interest rates, which means that if the interest rate rises, then earnings and stock prices will decrease, and vice versa. This further leads to low future discounted valuations as the discounted cash flow of future rates increases.

When the central bank of any nation increases the interest rate, it leads to a ripple effect in the economy as the costs of borrowing increase for all the individuals and institutions in society. These ripples travel the economy as, when the interest rate rises, the disposable income of households decreases, leading to a fall in consumer demand. Moreover, since the cost of borrowing has increased, it makes more sense for businesses to cut back on their investment. Both of these effects lead to a decrease in the earnings ratio of the stock, eventually pulling down the stock price.

Relationship Between Higher Interest Rates and Layoffs in the Tech Sector

When it comes to the tech sector, we have to keep in mind that a large proportion of its funds come either from venture capitalists, hedge funds, or angel investors. Since these financial institutions have a greater risk appetite, they invest a substantial amount of money in the tech sector in the hope of gaining higher profits and eventually beating the market.

However, this actually leads to a problem in the long run. As we know, the tech sector raises capital by diluting the founder’s equity, which eventually leads the founder to lose control over crucial decisions. Since the founder now holds less equity than the investors, he is now legally obliged to follow the investors’ decisions and execute the plans as drafted by the majority.

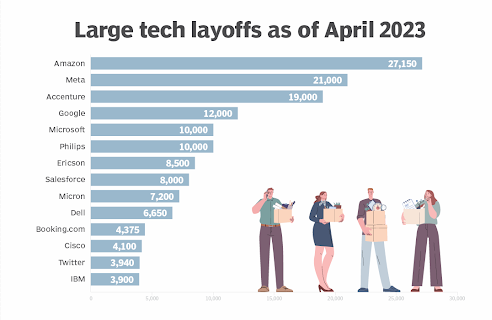

As a result, when the interest rate increases, it leads to a fall in the earnings ratio, thus forcing the investors to shift their focus to reducing costs. This leads to an increase in offshore work, thus leading to layoffs in the domestic nation. Further, since interest rates are increasing due to inflationary pressure, it gives a signal to the investor that it is less favorable for business expansion Hence, leading to business layoffs to improve the earnings ratio and eventually profiting from the increase in the stock price. Hence, it can be concluded that a direct relationship exists between layoffs and an increase in interest rates.

Relationship Between Layoffs and Share Price

After the recent hike in interest rates, the profit margins for producers and investors have decreased drastically. Under such challenging economic conditions, coupled with supply chain breakdowns and geopolitical issues, the most efficient cost cutting methods for tech firms are layoffs.

Since most of the tech firms are in the service sector, such as SaaS, a major portion of their cost is spent on giving salaries and compensation to employees. When times are bad and interest rates are rising, the earnings and profitability of these tech firms decrease. This eventually has a ripple effect on the stock price as investors become pessimistic after seeing the financials of the firm before investing. At its core, the price of a stock works on the basic principle of supply and demand. Since operating profits and earnings are reduced due to a higher interest rate, it sends out a signal to the market that the firm is not performing well. This results in reduced demand and is sometimes coupled with the selling of stock as well. This sudden fall in demand, despite supply remaining approximately the same, leads to a fall in the price of the stock.

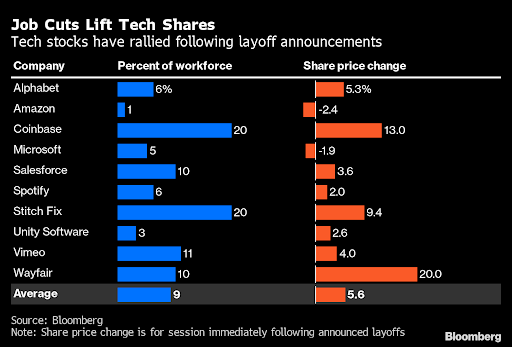

As a result, investors force their portfolio companies to pursue layoffs so that the earning ratio and profitability shown in the quarterly results can be increased. Further, mass layoffs send a signal that the executive and board of directors are ready to take tough decisions to improve the financial health of the firm. Thus, it has been seen that in the short run, mass layoffs are seen as a way to cut costs and increase revenue and profitability. This sends a signal to potential investors that the executives are taking tough calls and doing their best to improve the growth and financial health of the company. As a result, demand increases while supply remaining the same leads to an increase in the stock price.

However, it is to be noted that this works only in the short run, provided that the expectations of the investors and the actual performance of the same company are on the same page. It has generally been seen that when there is a disconnect between investor’s expectations and the actual performance of the company, many early investors dilute their shares. This news spreads like wildfire, forcing other investors to also dilute their shares, thus leading to a decrease in stock prices in the long run.

Conclusion

It can be concluded from the above data presented and the reasoning mentioned that, in the short run, mass layoffs send a signal to the market, especially to potential investors, that the management of the firms is trying their best and taking tough calls to improve the financial health of the company. This sends a wave of optimism, resulting in increased demand and thus an increase in share price.

However, it is to be noted that it is not necessary that share prices increase after mass layoffs. If there is a disconnect between the investor’s expectations and the actual performance of the firm, then it will ultimately result in a fall in the share price.

References

- Livemint. (2022, March 17). US Federal Reserve approves first interest rate hike after Covid-19 outbreak, signals more hikes ahead | Mint. Mint.

- Hansen, S. (2023, February 7). Why Layoffs Can Actually Lift a Company’s Stock Price.

- TRADING ECONOMICS. (n.d.). United States Fed Funds Rate – 2023 Data – 1971-2022 Historical – 2024 Forecast.

- DePillis, L. (2022, May 18). What Higher Interest Rates Could Mean for Jobs. The New York Times.

- Stations, F. T. (2023, April 4). Tech layoffs, high interest rates are having ‘serious impact’ on how people buy homes. LiveNOW From FOX | Breaking News, Live Events.

- Why Layoffs Can Actually Lift a Company’s Stock Price – Raleigh News & Observer. (2023, February 6). Raleigh News & Observer.

- Milstein, E., & Wessel, D. (2022, March 9). What did the Fed do in response to the COVID-19 crisis? Brookings.

Recent Comments